estate tax change proposals 2021

Staff accountant Norbert Jurkiewicz. The 2021 estate tax exemption is currently 117 million which was an increased amount from 545 million enacted under the Tax Cuts and Jobs Act of 2017.

Unprecedented Changes Proposed To Gift And Estate Tax Laws Barnes Thornburg

Here are some of the possible changes that could take place if Sanders proposed tax changes become law.

. Reducing the estate and gift tax exemption to 6020000. Current Transfer Tax Laws. Proposals to decrease lifetime gifting allowance to as low as 1000000.

This Alert focuses on the changes that directly impact common estate planning strategies. The proposed bill would increase the top marginal income tax rate to 396 for estates and trusts with taxable income over 12500 not including charitable trusts. The current 2021 gift and estate tax exemption is 117 million for each US.

The proposal seeks to accelerate that reduction. The federal gift estate and generation-skipping transfer GST tax exemptions that is the amount an individual can transfer free of any of. This last week House Democrats released details of a new tax proposal to support the 35 trillion.

Thankfully under the current proposal the estate tax remains at a flat rate of 40. Congress is currently debating possible changes to the tax code. Moore Attorney in the Estate Planning Probate Practice Group.

The law would exempt the first 35 million dollars of an individuals. Second the federal estate tax exemption amount is still dropping on January 1 2026 from 11 million to 5 million adjusted for inflation. So a family could end up paying both a transfer tax and then an estate tax and with the exclusion set to return to a level somewhere around 6 or 7 million many farms.

That is only four years away and. The 2021 exemption is 117M and half of that would be 585M. The Biden Administration has proposed significant changes to the.

Tax rates for C corporations were not. Proposed Build Back Better Act. The federal estate tax exemption is currently 117 million and the New York estate tax exemption is currently approximately 59 million adjusted for inflation.

July 13 2021. This article is original content written by local Manchester CT CPA firm Borgida Company PC. The New Death Tax In The Biden Tax Proposal Major Tax Change.

The proposed legislation would cause the increased exemption to expire at the end of 2021 instead of 2025. No California estate tax means you get to keep more of your inheritance. The top income tax rate of 37 and the top tax rate of 20 on investment income was not raised except for those subject to the surtaxes.

2 million at death5 The remaining 10 million is subject to a 40 estate tax. However the federal gift tax does still apply to residents of California. By Jeffrey G.

If such proposal is adopted the resulting federal gift and estate tax exemption would reduce to just over 6 million as of. Starting January 1 2026 the exemption will return to 549 million. And while the gift and estate tax exemption is scheduled to drop to approximately one-half the current amount on January 1 2026 there also are tax proposals in play that could.

California does not levy a gift tax. In 2021 Husband alone makes a gift of. The September proposal accelerated this sunset to the end of 2021 so the base exemption available to taxable gifts and estates would be 5 million 62 million adjusted for.

The current 2021 gift and estate tax exemption is 117 million for each US. Under the current tax law the higher estate and gift tax exemption will Sunset on December 31 2025. On March 25 2021 Senators.

Build Back Better Act Trusts And Estates

Biden Greenbook Estate Tax Proposals Should You Care

2021 Tax And Rate Budgets City Of Hamilton Ontario Canada

Billionaires Tax On Capital Gains Invites Tax Collection Volatility

Proposed Federal Tax Law Changes Affecting Estate Planning Davis Wright Tremaine

It May Be Time To Start Worrying About The Estate Tax The New York Times

A Closer Look At 2021 Proposed Tax Changes Charlotte Business Journal

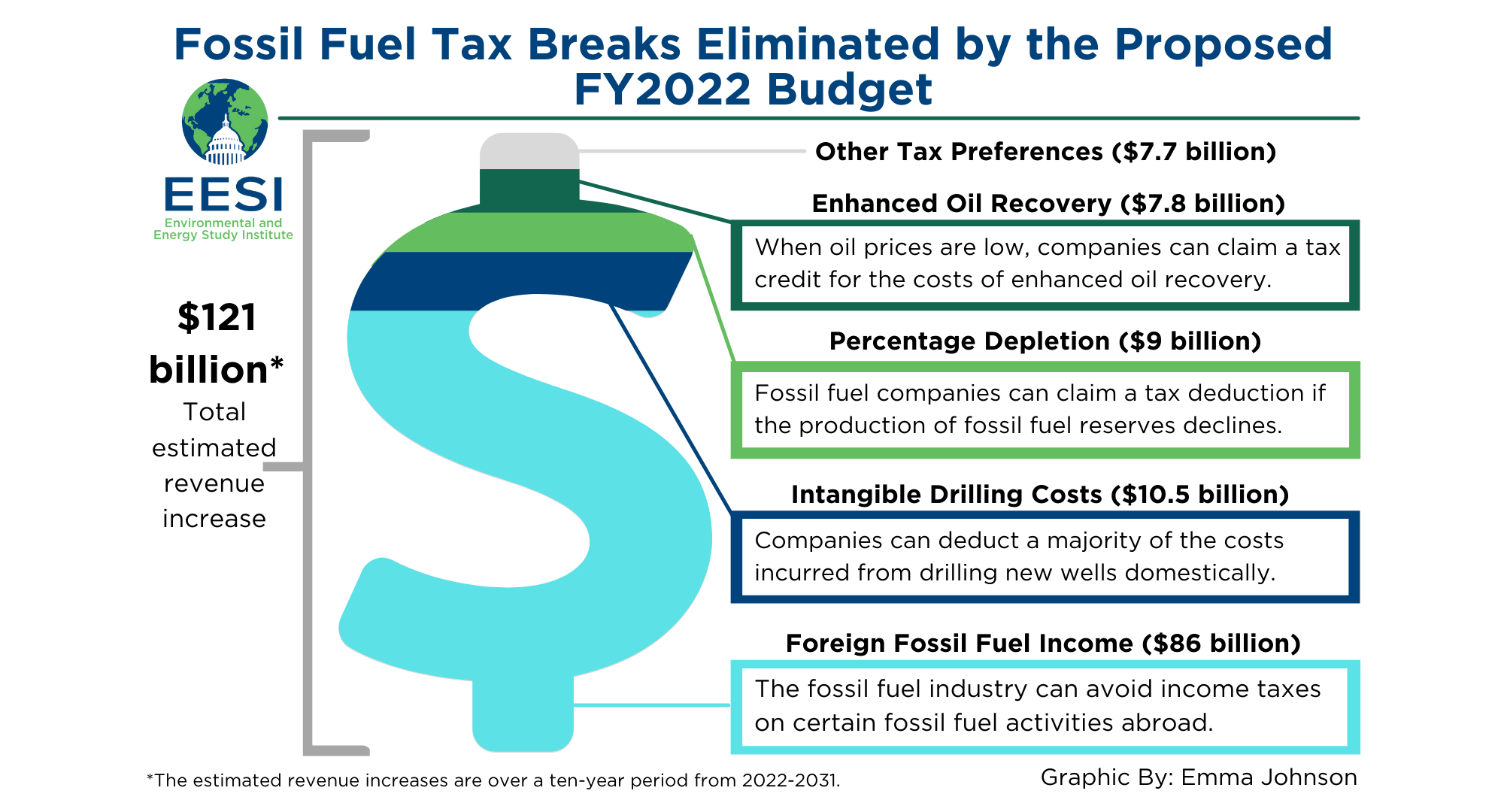

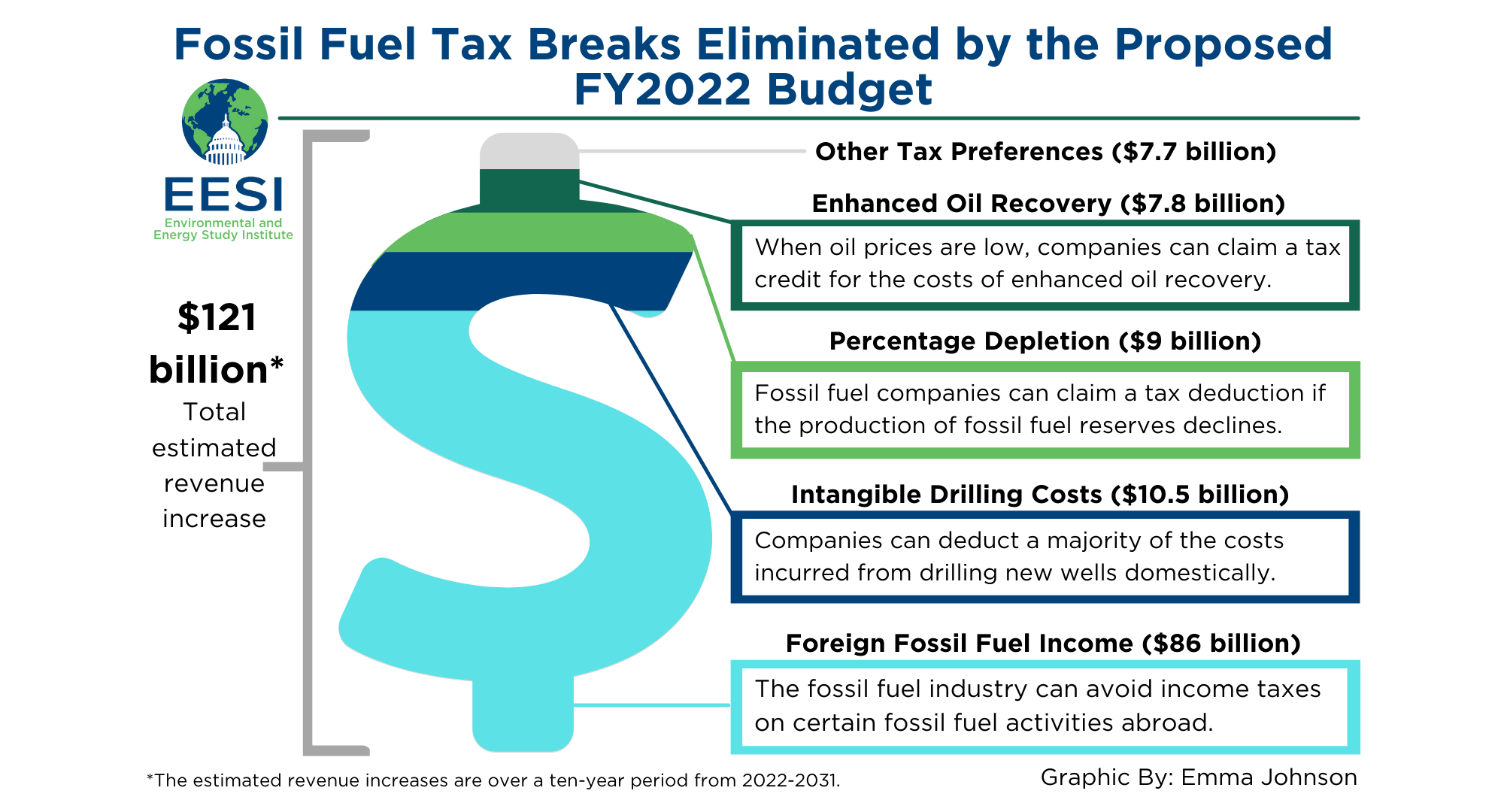

Fact Sheet Proposals To Reduce Fossil Fuel Subsidies 2021 White Papers Eesi

Reconciliation Bill Capital Gains Tax Proposals Tax Foundation

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

Possible Changes Coming To Tax On Capital Gains In Canada Smythe Llp Chartered Professional Accountants

Biden Banks On 3 6 Trillion Tax Hike On The Rich And Corporations The New York Times

Billionaires Tax On Capital Gains Invites Tax Collection Volatility

Possible Changes Coming To Tax On Capital Gains In Canada Smythe Llp Chartered Professional Accountants

Proposed Tax Changes For High Income Individuals Ey Us

Ey Tax Alert 2022 No 27 Ontario Budget 2022 23 Ey Canada

The New Death Tax In The Biden Tax Proposal Major Tax Change